Reporter: Asnil Bambani Amri | Editor: Asnil Amri

JAKARTA. The Indonesian government today formally took over as owner of aluminium producer PT Indonesia Asahan Aluminium (Inalum), Southeast Asia’s only aluminum smelter, ending the 30-year management by a majority-Japanese consortium.

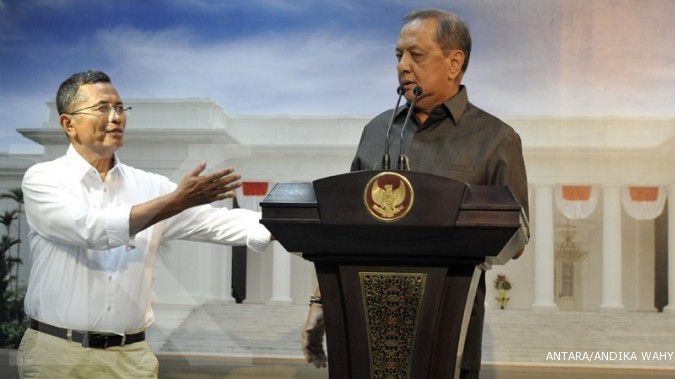

Indonesia and Japan signed the Asahan Project takeover agreement at the Industry Ministry in Jakarta, on Monday, Antara news agency reported.

The company’s takeover was planned to be completed on Oct. 31; but protracted negotiations had delayed the signing of the agreement.

Asahan Project is an Indonesia-Japan friendship partnership that will develop a hydroelectric plant (PLTA) in Toba Samosir regency and an aluminum smelting factory in Kuala Tanjung, Batu Bara regency, North Sumatra.

According to Asahan Project’s master agreement, Inalum’s operational period lasted for 30 years, starting from Nov. 1, 1983 to Oct. 31, 2013.

Inalum’s share ownership changed several times before the final agreement, in which 58.87 percent of shares belonged to Japanese investors and the remaining 41.13 percent were owned by the Indonesian government.

Inalum has an initial production capacity of 225,000 tons of aluminum ingot per year with electricity supplied from 640-megawatt-PLTA Asahan II. (The Jakarta Post)

Cek Berita dan Artikel yang lain di Google News

/2013/12/09/1368380993.jpg)